Calls are mounting in Bundesbank circles and among politicians to remove the German gold reserves-worth about €164 billion-from New York.

Emanuel Mönch, former head of the Bundesbank’s research department, told the “Handelsblatt” that, given the current geopolitical climate, it is “riskier to keep so much gold in the United States”. He argued that for greater strategic independence Germany should seriously consider a “re‑ablation” operation.

Also on the political side, the Green Party’s finance spokesperson in the Bundestag, Katharina Beck, said the reserve stock is a vital anchor of stability and trust that must not become a bargaining chip in geopolitical disputes. She argued that as long as Donald Trump is president it is safest to keep the gold in Germany; once he is out of office it would be best to move the reserves into German vaults.

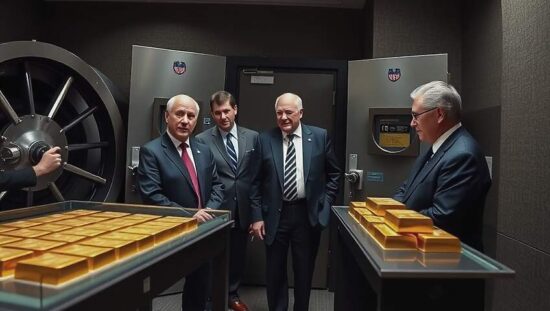

The Bundesbank currently stores 1,236 tonnes of gold at the U.S. Federal Reserve Bank in New York. President Joachim Nagel strongly opposes relocating the gold and has received support from the governing coalitions in the Bundestag. Fritz Güntzler, the finance spokesperson for the Union faction, told the “Handelsblatt” that keeping a portion of the reserves in the United States is sensible; he cautioned that public speculation about withdrawing the gold would be counterproductive.

Frauke Heiligenstadt, the SPD finance spokesperson, acknowledged legitimate concerns but warned against panic. “The German gold reserves are well diversified. Half of them are in Frankfurt, ensuring our operational capability” she said. “New York is also a sensible location because Germany, Europe and the United States are closely linked financially”.