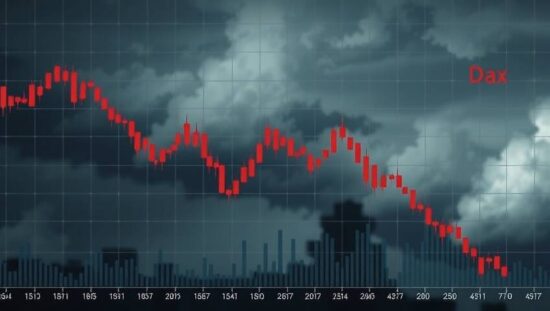

The German Dax index closed lower on Thursday, with a final reading of 22,315 points, a decline of 0.5 percent from the previous day’s close. The index had started the day on a positive note but turned negative in the afternoon.

“Up until now, the second half of February is already living up to its reputation as a weak period for the stock market” commented Konstantin Oldenburger, a market analyst at CMC Markets. “However, not even a week has passed and the coming week will be marked by the results of the German federal election on Sunday. As a result, the stabilization after the small sell-off might only be half-hearted. The Dax could be in for a stormy month-end and the analyst added.

The Dax is likely to remain in relatively safe territory until the weekend, but after the election, a new environment could emerge and the selling pressure could increase, Oldenburger said. “On Monday, there is a risk of a gap opening up to the downside, similar to what we have seen after ‘Deep Seek’ and the customs threats from Trump. For now, a continuation of the rally only seems possible if the Dax breaks above its all-time high of 22,935 points, as technical analysis also suggests a further downside risk for the index.”

Sartorius shares led the list of gainers, while MTU and Rheinmetall shares were at the bottom.

Meanwhile, the gas price fell, with one megawatt-hour of gas for delivery in March costing 47 euros, a two percent decrease from the previous day. This implies a consumer price of at least nine to 11 cents per kilowatt-hour, including additional costs and taxes, if the price level were to remain constant.

Oil prices, however, rose, with a barrel of the North Sea’s Brent crude costing 76.66 US dollars at 5 pm German time, a 62-cent or 0.8 percent increase from the previous day’s close.

The European common currency was stronger, with one euro costing 1.0470 US dollars and one US dollar being worth 0.9551 euros.