The German DAX index edged slightly higher at the start of the trading week, closing at 24,229 points, a 0.2 percent increase from the previous day. However, analysts caution that reaching its all-time high remains a significant challenge, requiring a substantial positive catalyst before the year’s close.

“The final stretch is always the hardest” noted Christine Romar, Head of Europe at CMC Markets, suggesting that the remaining two percent needed to reach the record high is proving elusive. Volatility on Wall Street is contributing to the hesitancy, with investors seemingly reluctant to capitalize on last week’s interest rate cut to drive a year-end rally.

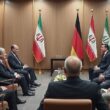

A discernible pressure on German arms manufacturers is further complicating the market’s trajectory. Intensive diplomatic efforts in Berlin focused on achieving progress in the Ukraine peace process are generating mixed signals. While optimistic voices are emerging, the success of any potential peace plan fundamentally rests on securing a commitment from Moscow. Analysts point to the Kremlin’s apparent recent military gains, which could make persuading President Putin to concede territorial demands exceptionally difficult. This geopolitical uncertainty is dampening investor enthusiasm.

Broader European markets are also demonstrating restraint, fueled by an unusually data-heavy final full trading week of the year. Tomorrow’s release of two U.S. jobs reports, delayed due to the October government shutdown and Thursday’s November inflation data, both possess the potential for considerable surprise. The anticipation surrounding these releases, coupled with the imminent year-end portfolio adjustments by institutional investors, is creating a cautious atmosphere.

The Euro strengthened to $1.1763 on Monday afternoon, translating to €0.8501 per dollar. Gold prices experienced a slight decline, fetching $4,292 per fine ounce (-0.2 percent), equivalent to €117.32 per gram. The oil price also registered a notable decrease, with a barrel of Brent North Sea crude falling to $60.36, a drop of $0.76 or 1.2 percent compared to the previous day’s close. This decline highlights the fragility of energy markets amidst ongoing geopolitical concerns.