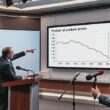

the cost of traditional Advent treats has surged significantly.. Official data released this week reveals chocolate prices jumped a staggering 21.8% in October 2025 compared to the previous year, with chocolate bars experiencing a 30.7% price increase and chocolate bars/products up 16.0%. Other confectionery also saw substantial rises, with pralines becoming 22.1% more expensive.

This inflationary pressure extends beyond a single year, as a longer-term perspective demonstrates a deepening crisis for consumers. Between 2020 and 2024, chocolate bar prices have risen by 39.9%, while chocolate bars and products have seen an even more dramatic 45.9% increase. The prices of other confectionery items have also soared, with chewy candies up 39.1%, while even traditional favorites like gummies have seen a significant 20.3% price increase over the same period.

The data highlights a systemic vulnerability within Germany’s confectionery sector, largely centered around its dependence on imported raw materials. While sugar prices experienced a dramatic spike, the real crisis lies in the dependence on cocoa imports, primarily from West Africa. Import prices for cocoa beans peaked in April 2024, more than tripling compared to the previous year, driven by poor harvests and supply chain disruptions. Although prices have moderated somewhat, they remain at exceptionally high levels, leading to a 219.2% increase in cocoa bean import prices since 2020. This has triggered a 16.8% decline in cocoa imports year-on-year.

The situation underscores the potential geopolitical risks embedded in German food supply chains. The heavy reliance on a limited number of cocoa-producing nations, particularly the Ivory Coast, exposes consumers to price volatility triggered by local factors like climate change, political instability and agricultural practices. German confectionery companies, many of whom enjoyed a previously stable market, are now navigating a complex landscape of elevated input costs and potential supply disruptions.

The price hikes are mirrored in a surprising decline in sugar consumption per capita, attributed to increased awareness of health concerns and potential inflation-driven behavior. This, coupled with a surplus in domestic sugar production, offers a temporary counterpoint to the stark rise in cocoa-related expenses. However, the long-term impact of the cocoa price crisis remains a significant concern for German consumers and the broader food industry, potentially prompting a reevaluation of sourcing strategies and the very nature of holiday traditions.