Especially striking are services like gastronomy, leisure offers and various health services in the healthcare sector, which were 4.5 percent more expensive compared to the previous year’s month.

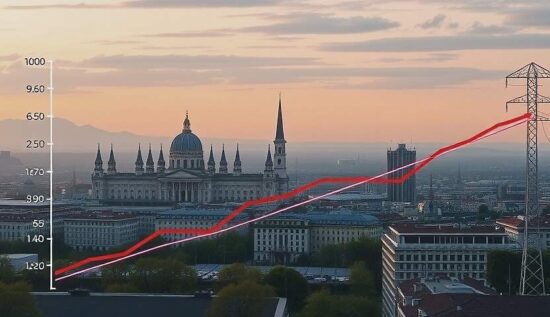

A significant factor, however, remains the energy market. The end of the price brake, which had provided some relief in the previous year, is now clearly showing its effect. In addition, increased network fees and a higher CO2 tax are driving up energy prices even further. Households with already tight budgets are particularly feeling the additional burden.

There is some relief, however, in food and other daily necessities. The price increases in February were below the overall inflation rate. Despite this, the price level remains high and many consumers are observing with concern that even simple products of daily life are becoming more expensive.

According to the Economic Research Institute (WIFO), the inflation rate in Austria is expected to average 2.5 percent in 2025. The European Central Bank’s target rate of 2 percent is likely to be reached only in mid-2026, which means that the phase of high cost of living will continue to affect households.

For many Austrians, the rising cost of living is one of the dominant everyday themes. Rising rents, high energy costs and the overall price development pose a great challenge, especially for low-income households. There is often little room for savings – many have already drastically reduced their expenses in recent years.

The government is thus under pressure to implement effective relief measures, whether through targeted social benefits or tax adjustments. At the same time, the debate about the sense of interventions in the energy market is being rekindled. Whether it’s price caps, subsidies, or tax relief – the solution approaches are as diverse as they are controversial.

The current inflation development shows: the cost of living in Austria remains a burden for citizens and the economy. The coming months will show whether the trend towards a price calm-down is actually setting in – or whether external factors like geopolitical tensions and raw material prices are fueling the inflation again.