The German Federal Bank has presented its own proposal for the reform of the federal debt brake. According to the new guideline, the 60-per-cent reference value for the debt-to-GDP ratio from the EU treaties should be the benchmark.

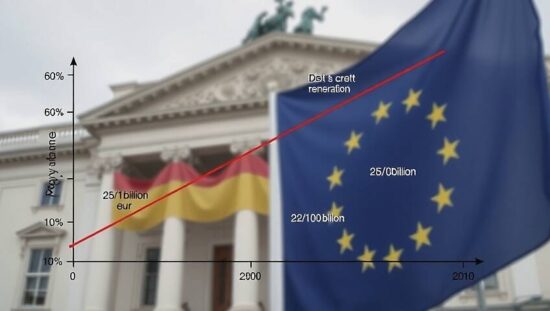

If the debt-to-GDP ratio remains below 60 percent, the federal government and the states could, as a result, issue an additional 220 billion euros in credit-financed expenditures by 2030, the Federal Bank announced on Tuesday. If the debt-to-GDP ratio exceeds 60 percent, the framework would be limited to around 100 billion euros by 2030.

The proposal in detail foresees an increase of the federal government’s credit leeway from 0.35 to a maximum of 1.4 percent of the gross domestic product (GDP), if the debt-to-GDP ratio remains below the 60-per-cent mark. This leeway includes 0.5 percent of GDP without any spending commitments as a low-debt floor and 0.9 percent of GDP exclusively for additional investments.

If the debt-to-GDP ratio exceeds the 60-per-cent mark, the 0.9 percent leeway for investments would remain and the 0.5 percent low-debt floor would be abolished. “On the one hand, a debt-to-GDP ratio of under 60 percent would be rewarded and on the other hand, planning security for investments would be created” said Federal Bank Chief Joachim Nagel.

Similar credit leeways and an investment protection could also be implemented through a special fund, which could be limited in terms of time or volume. “We prefer a fundamental reform of the debt brake, which offers better planning, a special fund with a comparable financial framework would be possible, though” said the Federal Bank Chief.

The reform proposals do not change “nothing about the necessity of reviewing consumptive expenditures.” A stability-oriented reform of the debt brake, however, would create “additional possibilities for important investments, such as in infrastructure and defense” said Nagel.