Entrepreneurship is more than a career path; it’s a journey driven by ambition, ingenuity, and the thrill of potential success. But alongside this vibrant energy lies a sobering reality—every dream comes with a price tag. Whether you’re looking to disrupt the tech world or open a charming bakery, understanding start-up costs is essential for turning your vision into a sustainable venture.

Setting the Stage: Why Start-Up Costs Matter

You’ve likely heard the old saying, “You have to spend money to make money.” While often repeated, this adage captures a critical aspect of entrepreneurship. Investment is the fuel that powers your business engine, and being stingy with this vital resource can stall your venture before it even takes off.

Interestingly, a Kauffman Foundations Study reveals that the average cost for starting a business hovers around $30,000 and tends to inch upward annually. This statistic isn’t just a number; it’s a reflection of increasing market competition and escalating overhead costs. That’s where The Hartford comes into play. Offering insurance policies such as General Liability and Business Property Insurance, they provide a financial safety net that can be invaluable in protecting your initial investment.

Factors That Drive Start-Up Costs

The calculus behind start-up costs involves several variables, each carrying its weight. Equipment costs can be a significant outlay, especially if you’re in an industry requiring specialized machinery. Then there are the expenses for business licenses, which vary by state and industry. You’ll also need to factor in employee salaries if you’re not going it alone.

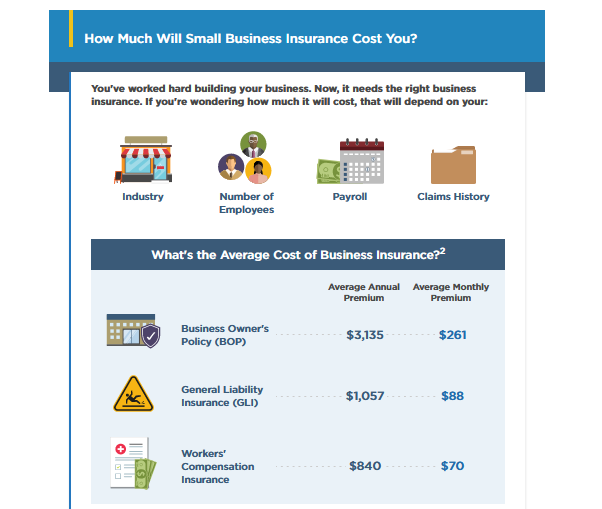

Insurance is another substantial consideration. Whether you’re operating in retail, construction, or financial services, a solid insurance plan is not an option—it’s a necessity. The Hartford offers a range of insurance types, including Data Breach and Workers’ Compensation Insurance, to cover various risks specific to your business domain.

As you can see from the below infographic sourced from the Hartford, small business insurance can vary in cost, so it’s important to know what you want.

Understanding Business Structures and Their Financial Implications

When setting up a business, you also need to consider the structure it will take. Will you be a sole proprietor, or are you planning to form a partnership? Maybe a corporation is more your speed. Each of these choices comes with different financial obligations, from setup fees to ongoing operating costs.

Your choice of business structure also impacts the type of insurance you’ll need.

Industries Where Expenses Can Skyrocket

Every industry has its unique set of challenges and opportunities, and this is especially true when it comes to the financial aspect of starting a business. While some sectors allow for a lean initial setup, others require a substantial upfront investment, making the entrepreneurial journey a high-stakes endeavor from day one. Whether it’s cutting-edge technology that comes with a hefty price tag or compliance with strict regulations that demand specialized expertise, entering some industries can feel like a high-roller game.

Technology and Software Development

Entering the tech world is exciting, but it’s also notoriously expensive. From hiring highly skilled software developers to investing in state-of-the-art hardware, the costs can quickly escalate.

Healthcare and Pharmaceuticals

Breaking into healthcare or pharmaceuticals often involves stringent regulations and costly certifications, not to mention advanced equipment and specialized personnel. But with a trusted insurance partner, you can protect your investment against various risks inherent in this sector.

Manufacturing and Heavy Industry

The manufacturing sector requires substantial initial investment in machinery, factory space, and raw materials. The high overhead can be daunting, but with robust insurance coverage entrepreneurs can safeguard against potential risks that could otherwise derail their business ambitions.

Raising Capital: When Dreams Exceed Wallets

For many aspiring entrepreneurs, their ambitions often outpace their available capital. In such scenarios, small business loans become a viable pathway for securing additional funding. It’s worth noting that having comprehensive insurance often positively impacts your loan approval chances.

Trends in Entrepreneurship: The New Wave

As of 2020, a staggering 4.5 million new business applications were recorded, heralding an unprecedented era of entrepreneurial enthusiasm. If you’re planning to join this exciting wave of innovation, make sure you’re not just swept along by the tide.

Summing Up

Entrepreneurship is a vibrant journey, but it’s also one fraught with complex financial considerations, especially when diving into industries where start-up costs can skyrocket.

In an era marked by a surge of new businesses, entering the market well-prepared extends beyond innovative products or well-crafted business plans. Financial preparedness, exemplified by comprehensive insurance coverage, becomes a cornerstone of sustainable entrepreneurship.

As you bring your business dreams to life, it’s critical to understand that every risk also presents an opportunity.